Top 15 Best Financial Advisors in Auckland Compared

Losing track of your finances or need some game-changing business advice? If you are, you should consult with the best financial advisors in Auckland to get the best financial advice for any situation.

In this article, we picked out the best authorised financial advisors in Auckland that you can trust your finances with. We also considered those who have excellent client reviews and can give you full support and guidance during the entire process.

If you’re ready, here’s our list of the best financial advisors in Auckland.

The Best Financial Advisors in Auckland Reviewed

1) Daniel Carney – Goodlife

| BEST FOR | Retirement finance planning |

| SERVICES | Financial and Retirement PlanningResidential Property Investment

Mortgage Advice & Structures Kiwisaver UK Pension Transfer & Aus Super Transfer Managed Funds WealthBuilder Risk Management & Mitigation |

| WEBSITE | https://www.goodlifeadvice.co.nz/about/ |

| ADDRESS | Solutions House, unit a3/59 Apollo Drive, Auckland 0632, New Zealand |

| CONTACT DETAILS | +64 9-580 1966[email protected] |

| OPERATING HOURS | Monday – Friday: 8.30 AM – 5.00 PM |

Are you planning to retire comfortably with enough savings and not worry about anything? Then you should ask Daniel Carney, one of the best financial advisors in Auckland, to help you.

What’s great about him is that he specializes in retirement finance planning including mortgage structuring, Kiwisaver, UK pension transfers, and risk management and mitigation.

Lots of Kiwis retire with little to no savings, unable to enjoy their retirement and do the things they’ve always wanted to do. This is why most Kiwis actually need financial advice in NZ.

But as early as now, Daniel can offer contingency plans and innovative solutions for you to achieve a comfortable and enjoyable retirement.

Highlights

- Specialises in retirement finance

- Authorised financial advisor

- Offers innovative solutions and products

Customer Reviews

One client, Bronwyn, shared his positive experience on working with Daniel:

“My wife and I have worked with Daniel on a managed fund and more recently two investment property purchases and his service has been nothing short of exceptional. Daniel’s support and advice come from a place of personal experience and nothing is ever too much trouble. The patience he has shown us while we went through several questions and moments of cold feet really helped us and we are delighted with what will be the start of a large portfolio with the help of Goodlife Advice. Aside from these investments, he’s always happy to talk and share his thoughts around commodities, cryptocurrency and other ways for you to increase your wealth. We now consider Daniel a dear friend, and strongly recommend him and his team for their integrity, knowledge and guidance.”

2) The Private Office

| BEST FOR | Wealth Management |

| SERVICES | Goals Based Financial Planning and Wealth Management |

| WEBSITE | https://www.theprivateoffice.co.nz |

| ADDRESS | Level 2, Princes Court, 2 Princes Street. Auckland 1010, New Zealand |

| CONTACT DETAILS | Contact [email protected] |

| OPERATING HOURS | 24/7 |

Through its goals based financial planning, The Private Office provides financial advice in NZ to help clients achieve their financial goals and independence. This is backed by an evidence based and socially responsible investment approach and ongoing relationship management to ensure clients stay on track to achieve their goals.

They operate 24/7 so that’s also an important factor to consider when choosing the best financial advisor in Auckland.

Highlights

- Goals based financial planning

- Socially Responsible Investments

- Evidence-based investment approach

- Broad diversification and low cost investments

- Ongoing relationship management

3) Darcy Ungaro – Ungaro & Co.

| BEST FOR | Customer-tailored financial plans |

| SERVICES | MortgagesKiwisaver

Insurance Financial Strategy |

| WEBSITE | https://ungaro.co.nz/about/ |

| ADDRESS | 28 College Hill, 1011 Ponsonby, Auckland, New Zealand |

| CONTACT DETAILS | 09 360 2179[email protected] |

| OPERATING HOURS | Monday – Thursday: 10.00 AM – 7.30 PMFriday: 10.00 AM – 5.00 PM |

Darcy Ungaro stands out from rival financial advisors in Auckland by listening openly and honestly to clients and dishing out sensible finance solutions for them.

He doesn’t let technology interfere with establishing a genuine relationship between him and his client. He adopts a customer-centric approach so that his clients will receive financial solutions that are individually-tailored to their needs.

He offers financial advice for mortgages, Kiwisaver retirement savings, financial strategies, and insurance. He also provides financial guidance to the listeners of his acclaimed investment podcast “The NZ Everyday Investor”.

He’s not afraid to break out of the norm and adjust to the trends and market changes. Darcy is a reliable, informed and helpful financial advisor, with numerous positive client experiences that can attest to his skills.

If you need investment advice in Auckland on top of money management, Darcy Ungaro is one of the best financial advisors you can contact.

Highlights

- Knowledgeable and experienced advisor

- Customer-centric advice model

- Generous in helping his clients

Customer Reviews

Hannah and Logan shared this testimonial on Ungaro & Company’s webpage:

“We are so thankful we took Darcy’s advice around Income Protection insurance when sorting out our insurances post purchasing a property. Logan became very unwell quite suddenly and was unable to work for just over a year. Not something you ever imagine will happen to you, let alone in your 30’s. We were fortunate to be able to stay in our home and focus on Logan getting better, instead of how we were going to meet our mortgage re-payments or having to consider selling. Thanks Darcy, you really did save us from what could have been an even more stressful situation.”

4) Rod Mudgway – Brackenridge Financial Solutions

| BEST FOR | Risk and wealth assessment and management |

| SERVICES | Risk ManagementCash Management

Debt Reduction Investment Planning Estate Planning |

| WEBSITE | https://www.brackenridge.biz/ |

| ADDRESS | 109 Jervois Road, Herne Bay, Auckland 1011, New Zealand |

| CONTACT DETAILS | 09 360 71380800 088 116 |

| OPERATING HOURS | Monday – Friday: 9.00 AM – 6.00 PM |

As one of the best financial advisors in Auckland, Rod Mudgway takes pride in delivering quality and personalised financial advice that meets your specific goals.

It doesn’t matter if you’re still young or already planning for your retirement. Rod focuses on getting right insurance and debt reduction and investment plans for you.

Aside from being a licensed financial advisor in Auckland, he also understands that it’s important to treat clients with honesty and integrity. He upholds these values by keeping all your information and data strictly confidential.

What’s more, Rod follows a 5-step methodology. This starts with profiling your needs and requirements and then creating a solid financial plan to achieve your goals.

Highlights

- Personalised financial advice

- Professional and accommodating

- Keeps your information confidential

- Conducts an organised 5-step process

Customer Reviews

One client, Stephanie H., shares this glowing review on Google:

“Rod has been advising us for over 15 years! He is great to deal with, he is always looking out for our changing needs and recommends what is best for us, even if this is not going to be good for his own pockets! Nothing is too much trouble for him. He is knowledgeable about what he does and a pleasure to deal with. We completely trust Rod’s advice. He is also excellent at following us up for reviews.”

5) Roger Sutherland – Private Wealth Advisers

| BEST FOR | High-networth individuals and family trusts |

| SERVICES | Financial PlanningRetirement Planning

Investment Planning Tax Efficiency Wealth Creation Cash Flow Management |

| WEBSITE | https://www.privatewealthadvisers.co.nz/about/roger-sutherland-2/ |

| ADDRESS | Level 1, Suite 1, 1 Faraday Street, Parnell, Auckland, New Zealand |

| CONTACT DETAILS | +64 (0)9 308 2974+64 (0)21 411 924 |

| OPERATING HOURS | — |

Roger Sutherland is an authorised financial advisor and the director of Private Wealth Advisors. He has over 35 years of experience in the finance and trust industry.

With his services, you won’t be limited to cliché, prescribed solutions that other financial advisors will provide. Instead, he will offer customised financial advice and action plans to build your wealth and/or maintain financial stability.

His areas of expertise include financial planning, retirement planning, investments, and wealth building. Also, he can fix any issues you may have with your cash flow.

Aside from that, he works in partnership with the leading accountants and lawyers in New Zealand. As a result, you’ll get a top-notch and seamless service from him.

If you need financial advice and a reliable investment adviser in Auckland, you should try to contact him soon.

Highlights

- Gives invaluable financial advice

- Over 35 years of experience

- Personalised service

- Works with leading professionals

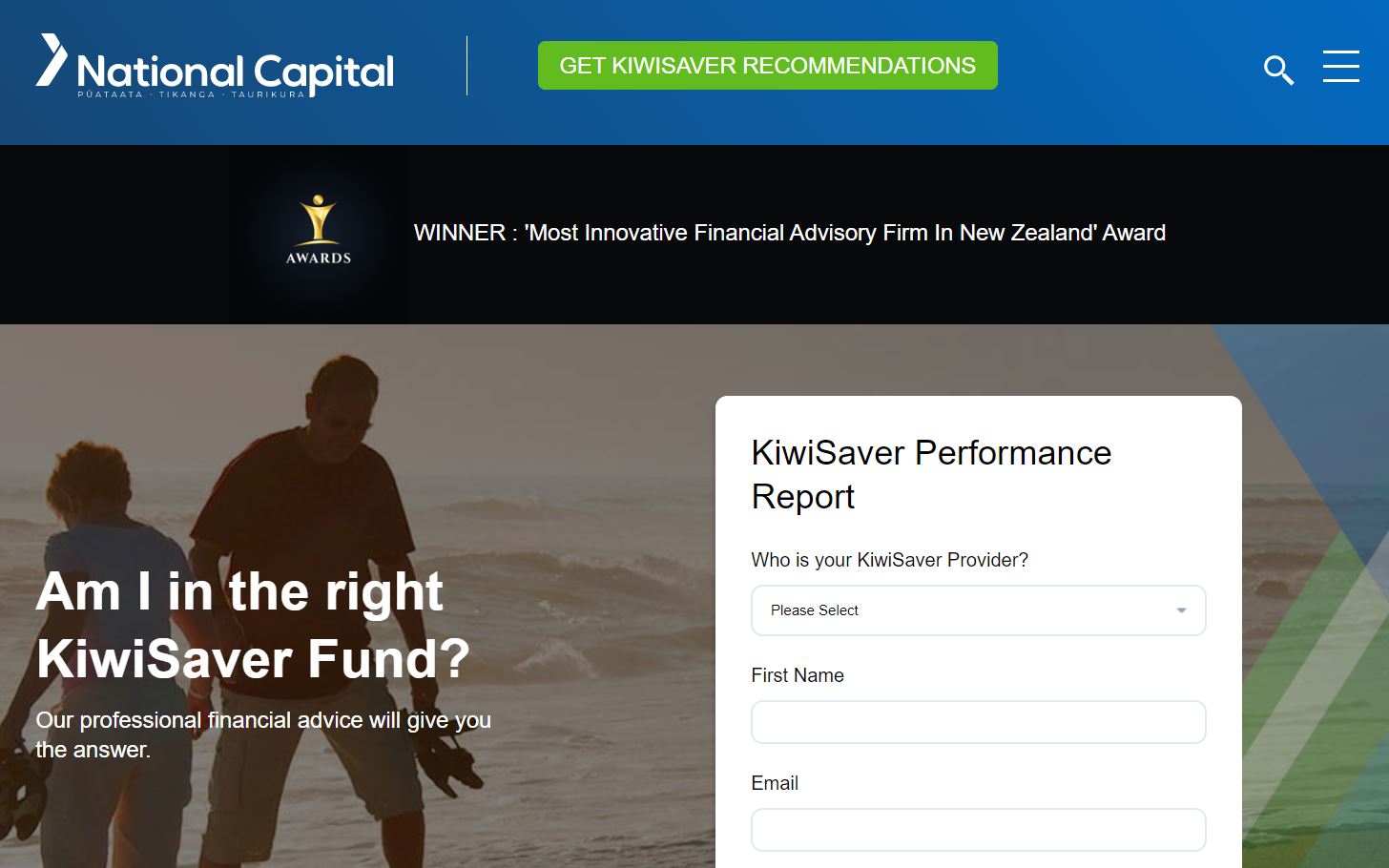

6) National Capital

| BEST FOR | Free KiwiSaver Recommendations |

| SERVICES |

Investment, Savings, KiwiSaver & Investment research

|

| WEBSITE | https://nationalcapital.co.nz/ |

| ADDRESS |

PO Box 2134, Shortland Street, Auckland 1010

|

| CONTACT DETAILS |

+64 21 0499 703 | [email protected]

|

| OPERATING HOURS | Open daily |

National Capital was founded in 2018 and now advises Kiwis on over $80 million of their KiwiSaver savings. They are based in Auckland, but serve clients all over New Zealand. They provide free personalised KiwiSaver advice, with the goal of empowering one million kiwis to become financially secure.

The team consists of professional financial advisers using the latest technology to give you personalised recommendations, at no cost to you. They do all the work in the backend so you don’t have to, making them one of the best financial advisors in Auckland and the whole of NZ.

Highlights

- Uses the latest technology

- Offers personalized recommendation and advice

- 100% transparency

- Expert adviser

7) kōura

| BEST FOR | Financial Advising |

| SERVICES | Financial Advising |

| WEBSITE | https://www.kourawealth.co.nz |

| ADDRESS | PO Box 4349, Shortland Street, Auckland 1140 |

| CONTACT DETAILS | [email protected] 0800 527 547 |

| OPERATING HOURS | 24/7 |

Investing is pretty risky, especially if you’re diving into it without much experience. Fortunately, kōura can help you do the safest investments while maximising your returns.

They’re one of the best investment advisers in Auckland for those who are into passive investing.

kōura is a company that focuses on passive investing, which involves investing only in the entire market. It’s safer than investing on individual businesses, while profit is guaranteed since they only invest in reliable companies.

With kōura, your account can grow at the best pace, with as little risk as possible.

Highlights

- Passive investor

- Personalised financial plans

- Chooses the most reliable companies to invest in

- Lower fees

8) Custom Financial Solutions

| BEST FOR | Financial advisers |

| SERVICES | Services |

| WEBSITE | http://customfinancial.co.nz/ |

| ADDRESS | Unit 1/26 Putiki St, Grey Lynn, Auckland 102 |

| CONTACT DETAILS | Email: [email protected] Phone: 021 083 52332 |

| OPERATING HOURS | Open 24 hours |

Custom Financial Solutions has worked in the Financial Services industry for ages, but they only had a single offering. Now, they solely work for their loyal clients.

The expert team of financial advisors in NZ speak the language of their customers, and knows how they can get the best outcome. With their experience in this field, Custom Financial Solutions genuinely believes they can provide a solution.

Their work is like magic and they love doing things the right way. They specialise in life insurance, income protection insurance, total and permanent disability insurance, trauma insurance, private medical insurance and others.

Highlights

- Professional team members

- Easy solutions

- Personalised services

9) Sam Kodi – Sam Kodi

| BEST FOR | Investment planning |

| SERVICES | Wealth ProtectionFinancial Growth

Business Protection Business Growth |

| WEBSITE | https://samkodi.co.nz/ |

| ADDRESS | 315A Pakuranga Road, Pakuranga Heights, Auckland 2010, New Zealand |

| CONTACT DETAILS | +64 21 283 5065 |

| OPERATING HOURS | 24/7 |

Sam Kodi is an authorised financial advisor in Auckland specialising in financial planning and investment advice. His dedication in helping his clients achieve financial success makes him one of the best financial advisors in Auckland.

His passion for helping those in need stems from having experienced financial struggles in the past. Because of this, he aims to provide his client with proper and structured financial roadmaps to achieve their goals.

Sam and his partners will provide you with a complete financial solution for all your needs. Their team of professionals consists of accountants and real estate agents.

Highlights

- Authorised financial advisor

- Wide circle of partners

- Understands the struggles of clients

Customer Reviews

Shohan W., one of Sam’s many satisfied clients, left this positive review:

“With Sam an his super team, it is not all about the business. If you are looking to secure your financial future, then you will not regret giving Sam and his team a call and setting up an appointment.”

10) Lisa Dudson – Acumen

| BEST FOR | Property Investment |

| SERVICES | Consultation, Property Investment |

| WEBSITE | https://acumen.co.nz |

| ADDRESS | Princes Wharf, Auckland |

| CONTACT DETAILS | 09 921 0444 021 486 000 [email protected] |

| OPERATING HOURS | 24/7 |

Lisa Dudson is one of the most well-known best financial advisors in Auckland with over 20 years of experience. She is the author of numerous books and is regularly called upon by the media for her expertise.

Lisa provides a financial sounding board for her clients and specialises in helping you get strong financial foundations, determining the best strategy to achieve your goals and property investment.

Highlights

- Property investment expert

- Fee-based consultations

- A successful investor herself with a diversified portfolio

- Focuses on educating her clients and informed decision-making

11) Sara Hartigan – The Umbrella Company

| BEST FOR | Mortgage and Insurance Advising |

| SERVICES | MORTGAGES CAR FINANCE INSURANCE KIWISAVER |

| WEBSITE | https://www.theumbrellacompany.co.nz/ |

| ADDRESS | Auckland |

| CONTACT DETAILS | [email protected] 119 039 |

| OPERATING HOURS | 24/7 |

The Umbrella Company is composed of expert mortgage and insurance advisors. Their goal is to help clients purchase their homes and prepare on the off-chance the worst happens.

Sara Hartigan is one of the primary financial advisors of the company. She has 10 years of experience in the industry, some of it from her personal experiences.

They work with major banks around the country to continue offering the best financial advising services to their clients. Their services are available New Zealand-wide.

Highlights

- 10 years of experience

- Impressive track record

- Works closely with major banks

- Operates New Zealand wide

12) Saturn Advice

| BEST FOR | Saturn’s Portfolio Superannuation Scheme |

| SERVICES | Investment advice Financial planning |

| WEBSITE | http://saturnadvice.co.nz/ |

| ADDRESS |

Units 4 & 5, Shed 24 (Opposite the Hilton Hotel, 143 Quay Street, Auckland 1010, New Zealand

|

| CONTACT DETAILS | 0800 757 858 [email protected] |

| OPERATING HOURS | Monday – Friday: 8:30am–5pm |

Next on the list is Saturn Advice. It’s considered to be one of the leading financial advisors not only in Auckland, but for the whole of New Zealand. They handle investments, equities, bonds, cash flows, and even help with managing the KiwiSaver funds.

Saturn’s goal is to help people better their life through well-managed finances. They’re known for their impartial advices and recommendations based on previous experiences and research.

The way Saturn charges fees depend on the extent of their services to their clients. Regular financial advices are at a flat rate of $250 per hour, while directly managing a client’s investment range from 0.68% pa (+ GST) to 1.05% pa (+ GST).

If ever you’re interested in acquiring their assistance for any financial situation you may be in, you can head on to their website and fill out the form. Inquiries are also welcomed should you have any additional questions regarding their work. The first consultation is free so that’s another consideration for you when searching for the best financial advisor in Auckland.

Highlights

- Helps achieve financial freedom

- Flexible plans and advices

- Expert advisors

13) Money Empire

| BEST FOR | Unbiased information |

| SERVICES | Home Loan Empire, Insurance Empire, Financial Framework, Property Empire |

| WEBSITE | https://moneyempire.co.nz |

| ADDRESS | QB Studio 11, Level 1/208 Ponsonby Road |

| CONTACT DETAILS | +64-9-361-0050 [email protected] |

| OPERATING HOURS | Mon-Fri: 8 am – 5 pm Saturday & Sunday: Closed |

Money Empire is a financial advisor that prioritises their clients instead of profits. With that in mind, they strive to provide financial advice that helps their clients in the long run.

Unlike other financial advisors in Auckland, their communication is transparent, straightforward, and easy to understand. That means there won’t be any financial jargon to worry about, which gives clients a better idea of what their financial situation is.

Their team of financial advisors comprises of individuals who are not only qualified in their profession, but are also friendly and attentive to the clients they interact with. They’ll provide an attainable goal for you to work for, as well as a comprehensive plan you should follow to reach it.

Finally, they do all this with the latest available technology, so that the entire process remains seamless and hassle-free. Given their customer-oriented, high quality services, it’s not surprising that Money Empire is considered one of the best financial advisors in NZ.

Highlights

- Approachable and jargon-free advice

- Works for the long term

- Achievable outcomes

- Highly responsive

14) Dr. Rodger Spiller – Money Matters (NZ)

| SERVICES | https://www.moneymatters.co.nz/fees |

| WEBSITE | https://www.moneymatters.co.nz/ |

| ADDRESS |

Office Level 8, 139 Quay Street |

| CONTACT DETAILS | (09) 366 1672 [email protected] |

| OPERATING HOURS | Contact for details |

Next on our list is Dr. Rodger Spiller – the Founder, Managing Director and Financial Adviser of leading

ethical investment firm, Money Matters.

In the 1970s, inspired by New Zealand’s first ethical investors, Rodger chose to focus his career on helping people make money and make a difference.

He became a pioneering leader in the field, and is considered the “real father of ethical investing in New Zealand” (NewstalkZB, Oct. 2021).

Rodger’s experience in both ethical investing and the wider industry is world-class – making him a safe and trusted guide for his clients.

With a lifelong love of learning, Rodger completed his Bachelor of Commerce in 1983, a Master of Commerce (First Class Honours) in 1990, and a Ph.D. in ethical investment and ethical business in 1999.

Throughout his career, Rodger has held numerous influential leadership positions – including serving as a former Member of the Securities Commission (now the Financial Markets Authority) and bringing the Responsible Investment Association Australasia (RIAA) to New Zealand.

He also served as a Director of the RIAA for over ten years. Today, through Money Matters, Rodger brings his clients award-winning advice and trusted guidance – helping make New Zealand’s money matter.

Highlights

- Decades of experience in the industry

- Pioneered ethical investment in New Zealand

- Winner of the inaugural Financial Planner of the Year Award, 1999

- Winner of the inaugural Best Ethical Financial Adviser Award, 2021

15) National Capital

| SERVICES | Kiwi Savers |

| WEBSITE | http://nationalcapital.co.nz |

| ADDRESS | Princes Wharf, Auckland CBD, Auckland 1010, New Zealand |

| CONTACT DETAILS | +64 9 283 0460[email protected] |

| OPERATING HOURS | Monday – Saturday, 9:00 AM – 5 PM |

National Capital is one of the greatest Financial Advisors in the country, specializing in KiwiSaver and investment research. They were established in 2018 and currently advise Kiwis on over $70 million in KiwiSaver accounts.

They are situated in Auckland and service clients across New Zealand. They provide free KiwiSaver advice and hope to help one million Kiwis become financially secure.

Saturn Portfolio Management, its parent firm, has been in business since 1988 and presently advises customers on more than $400 million in assets.

They are supported by a fantastic team of support employees that assist them with client administration and KiwiSaver research. They’re also extremely fortunate to have an advisory board of highly experienced and clever Kiwis who will aid them on their goal to help 1 million Kiwis become financially secure.

Highlights

- Experienced financial advisors

- Supported by a fantastic team of support employees

- Provides free personalized KiwiSaver advice

And that’s it for the best financial advisors in Auckland. These people will give you solid financial plans that will sustain you and your business in the long run.

So far, do you have any questions or comments about our featured AFAs? If you have any, let us know by sending us a message and we’ll get back to you.

Aside from consulting with financial advisors, you may also want to check out the best accountants in Auckland to help you manage your business’s finances more effectively.